When cost segregation studies make sense and when do not

When you purchase a commercial building or rental property, you want to think of the possibility of cost segregation studies to create additional cash flow.

Why is this strategy a game-changer? What is cost segregation?

Cost segregation studies separate out 5, 7, and 15-year, shorter depreciable properties out of 27.5 or 39-year-depreciable building properties, thus allowing businesses and investors to accelerate depreciation and increase cash flow from tax deductions.

The most common myth about the cost segregation is that you will have increased audit risk.

Nope, that’s not true.

The government helps to lay out the rules on how these cost segregation studies work in timely manner to accurately reflect and report the value of the real estate.

They just don’t show you this information too much because it means decreased tax revenue for them.

It’s not uncommon to find tax returns never taking depreciation on any buildings (ever!) or average straight-line depreciation on buildings.

So here’s the situation when cost segregation studies make sense:

- You purchased a commercial building for office or manufacturing space for your operating business

- You and/or group of investors purchased a multi-family residential properties

- Either you or your spouse is a real estate professional and be qualified for special passive loss treatment

Here’s when cost segregation study does not make much sense:

- Your tax benefit is not large enough to justify the cost of study

- You can’t use the passive loss against other losses or earned income.

Let’s say you purchased a $2M commercial building through a real estate holding LLC which offers office space for your operating business LLC.

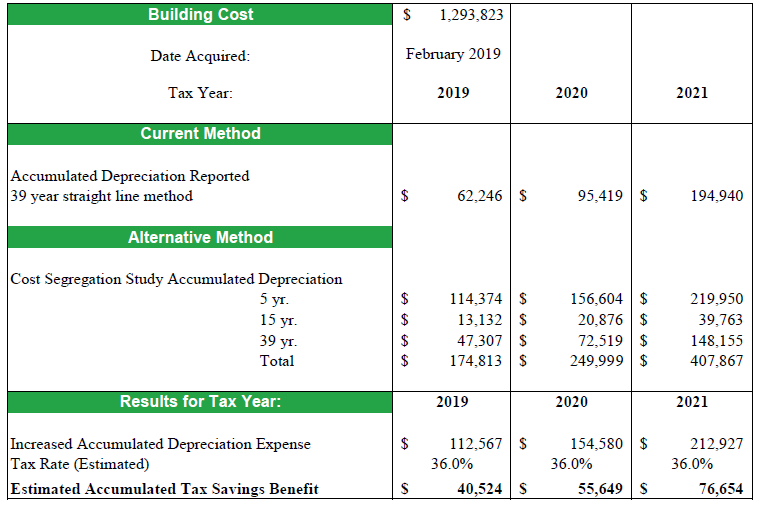

The Building cost is $1.3M.

You would normally receive $62,000 depreciation for the first year.

Cost segregation would allow you to enjoy $175,000 depreciation for the first year, which would be $113,000 difference!

Plus, because of the self-rental rule and grouping rule, you would not categorize rental losses as passive but be able to net against your operating business income.

A huge game changer.

If you have any inquiries regarding cost segregation, please feel free to contact UDAI HOSHI, CPA in Portland, Oregon.